Coming and Going: A Look at Employee Turnover in the Logistics Industry

https://morailogistics.com/coming-and-going-a-look-at-employee-turnover-in-the-logistics-industry/

There are several things when operating a business that despite the most careful planning, cannot be avoided: unexpected weather extremes affecting delivery times, changing customer expectation and demand, having to react to competitor innovation, and every business big or small having to deal with inevitable employee turnover. I’d like to focus this week’s post on the last point.

Data from the American Trucking Association (ATA) shows that the turnover rate at large truckload carriers rose one percentage point to an annualized rate of 97% in the third quarter of 2014. In 2013, the ATA presented data showing those with more than $30 million in annual revenue— averaged 96 percent for all of 2013, down 2 percent from the 2012. And that’s a drastic improvement over the all-time high of 130 percent turnover in 2005.

Employees in warehouses also have very high turnover rates, especially where large warehouses are concerned as shortages in the availability and quality of labor may have a lasting effect on a firm’s competitiveness. “Getting the right things to the right people at the right time” is the fundamental principle for any supply chain. What is sometimes forgotten in discussions is that for this principle to be enacted, a business needs the right training to be given to the right associates so the right skills can be cultivated and utilized. With that said, let’s look at some key items when discussing employee turnover in the logistics industry.

Who is Most Likely to Change Jobs?

A study from CareerBuilder measured worker satisfaction in the U.S as a whole and the logistics industry specifically. Of the workers surveyed, they found certain factors appear to make workers significantly more likely to change jobs than others:

- Workers who are dissatisfied with their job: 58 percent plan to change jobs in the New Year

- Workers who are dissatisfied with advancement opportunities at current company: 45 percent

- Workers who are dissatisfied with their work/life balance: 39 percent

- Workers who feel underemployed: 39 percent

- Workers who are highly stressed: 39 percent

- Workers who have a poor opinion of their boss’s performance: 37 percent

- Workers who feel they were overlooked for a promotion: 36 percent

- Workers who have been with their company two years or less: 35 percent

- Worker who didn’t receive a pay increase in 2013: 28 percent

Who is Most Likely to Stay?

The same study also looked at the top reasons as to why employees would stay in their current job. Though there were a variety of reasons, there were 8 reasons in particular that they found:

- “I like the people I work with.” – 54%

- “I have a good work/life balance.” – 50%

- “I have good benefits.” – 49%

- “I make a good salary.” – 43%

- “There still is a lot of uncertainty in the job market.” – 35%

- “I have a quick commute.” – 35%

- “I have a good boss who watches out for me.” – 32%

- “I feel valued and my accomplishments are recognized.” – 29%

Sometimes Goodbye Isn’t so Bad

A recent article by the International Business Times quoted a study from Payscale that demonstrated that of the fortune 500 companies, Amazon was second in the number of employee turnovers. Despite having some of the least loyal employees, Amazon’s high turnover isn’t necessarily a bad thing.

“A high employee turnover rate isn’t always because the company isn’t a good one to work for. When workers are willing to hop from job to job, it is usually an indicator of an improving job market”, Payscale’s lead economist Katie Bardaro said.

“Workers might be job-hopping more than before. This means that the industry is hot and the economy is improving,” she told Business Insider. “Some of the firms on [the high turnover] list are there, because they’re a hot market.”

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Is Canada’s Newly Proposed Rail Safety Laws Enough, Too Much, or Too Little?

https://morailogistics.com/is-canadas-newly-proposed-rail-safety-laws-enough-too-much-or-too-little/

On the 20th of February, Federal Transport Minister Lisa Raitt revealed The Safe and Accountable Rail Act which proposes amendments to the Canada Transportation Act and Railway Safety Act. The Act, which is a response to the Lac-Mégantic disaster in 2013, will make railways and crude oil shippers responsible for the cost of accidents said Raitt.

Along with other previously introduced rail safety requirements, this new act will introduce the following:

- Railways moving large volumes of crude oil will now be required to carry insurance of up to $1 billion to cover the costs of a potential accident.

- Oil companies shipping their product in railway cars, meanwhile, will now face a levy of $1.65 for every tonne of crude shipped roughly 23¢ per barrel.

- The Act will bring in minimum insurance requirements for railway crude oil shippers using federally regulated railways, from $25 million for carriers of minimally dangerous goods to $1 billion for substantial quantities of them.

- Two new liability insurance levels — $100 million and $250 million — will be phased in during the two years after the bill receives royal assent. Companies will be required to come up with half that amount in the first year and the full amount the year after that.

- Companies that ship crude oil will also have to pay a fee per tonne shipped that will go into a $250-million backup fund to cover costs above what their insurance covers if they’re involved in an accident involving crude oil.

Too Much or Too Little?

Although the reaction to the announcement of the Act has been mostly positive by the Canadian press, it hasn’t been without some controversy.

An article in the Financial Post quoted Greg Stringham, of the Canadian Association of Petroleum Producers’

vice-president of oilsands and markets, who expressed some concerns.

In today’s price environment, every little bit affects the economics. Crude oil prices have plunged more than 50% since June, causing many producers to cut spending.

Mr. Stringham said about 200,000 barrels of oil were moving by rail in Canada every day at the end of 2014. He continued by saying that oil and gas producers don’t know whether additional costs from the new insurance burden will cause oil-by-rail movements to become more expensive for producers.

Looking at the comments section of the articles covering this story, it’s easy to see that there is also the other side who feel that the newly proposed Act can isn’t being taken far enough. It seems that this sentiment stems from the recent Canadian Pacific Railway strike which ended just before employees would’ve been legislated back to work.

In a Maclean’s article, NDP Labour critic Alexandre Boulerice condemned the government for taking quick action against the workers when it was revealed that that there was a legislation being poised in end the strike. “It will put public safety at risk, since the problem of long hours and fatigue among those conductors will not be resolved,” he said at the time

A Problem With No Clear Solution

The growing number of train derailments has to do with the growing volumes of oil being shipped. This is a trend and problem for both Canada and the U.S. There’ve been different long-term solutions that have been recommended, but for now, let’s hope that the new Safe and Accountable Rail Act shows some promise in curbing this deadly trend.

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Infographic: 12 Facts Comparing BRICs and Other Emerging Markets in the Logistics and Supply Chain Industry

https://morailogistics.com/infographic-12-facts-comparing-brics-and-other-emerging-markets-in-the-logistics-and-supply-chain-industry/

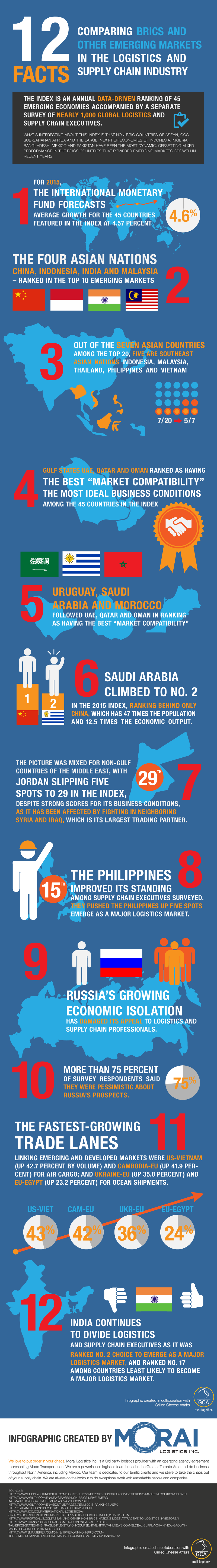

Although large BRICS nations Brazil, Russia, India, China and South Africa have accounted for much of the growth and investment in emerging markets, recent years has seen a general slowdown of the respective economies of these countries.

Instead, the non-BRIC countries of ASEAN, GCC, Sub-Saharan Africa and the large, next-tier economies of Indonesia, Nigeria, Bangladesh, Mexico and Pakistan have been the most dynamic, offsetting mixed performance in the BRICS countries that powered emerging markets growth in recent years.

This changing tide in growth economies is reflected in the 2015 Agility Emerging Markets Logistics Index, an annual data-driven ranking of 45 emerging economies accompanied by a separate survey of nearly 1,000 global logistics and supply chain executives.

The Index, ranks emerging markets based on their size, business conditions, infrastructure and other factors that make them attractive for investment by logistics companies, air cargo carriers, shipping lines, freight forwarders and distribution companies.

Infographic: 12 Facts Comparing BRICs and Other Emerging Markets in the Logistics and Supply Chain Industry

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

North American Intermodal Companies had a Strong Year, but Some Threats Still Loom

https://morailogistics.com/north-american-intermodal-companies-had-a-strong-year-but-some-threats-still-loom/

Last week, the Intermodal Association of North America (IANA) reported in its most recent edition of the Intermodal Market Trends & Statistics report, a strong full-year and fourth quarter 2014 performance for intermodal volumes despite harsh weather conditions, and continuing intermodal congestion.

An article from Logistics Management by Jeff Berman on the report noted that:

Total 2014 intermodal volume—at 16,276,892 containers and trailers––saw a 4.8 percent annual increase compared to 2013. Domestic containers—at 6,444,532—were up 5.7 percent, and international containers—at 8,166,010—were up 4.4 percent. All domestic equipment at 8,110,882—was up 5.1 percent, and trailers rose 2.9 percent to 1,666,350.

For the fourth quarter, total volume—at 4,111,401—was up 3.0 percent compared to the fourth quarter of 2013. Domestic containers were up 5.1 percent at 1,672,332, and international containers—at 2,011,754—were up 2.1 percent en route to leading all intermodal segments for the fourth year in a row and seven of the last eight years. Trailers eked out a 0.1 percent gain at 427,315, and all domestic equipment was up 4.0 percent at 2,099,647.

Based on IANA data, the report observed that 2014 marked the first time in three years that international, domestic containers, and trailers each saw annual gains, while showing the strongest overall intermodal growth since 2011. What’s more, international volume posted its largest annual increase since the economy was emerging from the depths of the recession in 2010, with the 4.4 percent annual growth rate almost double the previous three years, while total international volume was only 4 percent below 2006’s pre-recession peak. And 2014 trailer volume saw its first annual gain in three years, while seeing a 35 percent total decline in the past decade.

IANA President and CEO Joni Casey commented on the findings: “For the first time in four years, international, domestic container, and trailer market segments all posted year-over-year growth. And volume gains were widespread geographically, with eight out of nine regions recording increases during 2014.” IANA officials also suggested that the reason international growth exceeded expectations in the fourth quarter, was because of “stronger than expected container imports.”

Casey added that considering that the overall volume growth rate of 4.8 percent was above 2013, as well as higher than in 2012, 2014 intermodal industry performance modestly exceeded expectations.

The Skies Aren’t All Clear Yet

Although the findings in the report are very encouraging, an article written by Mark Szakonvi on JOC argues that caution is required going forward.

In particular, he noted that a number of threats from the reappearance of brutal weather conditions seen last year, to a West Coast port lockout could quickly derail the rail industry’s gains.

“The railroads aren’t out of the woods yet. Although the waterfront employers said on Jan. 26 that it had reached a tentative agreement on chassis maintenance and repair with the International Longshore and Warehouse Union— a major roadblock to a labor contract — there is still concern of a terminal lockout by employers. If that were to happen, BNSF Railway and Union Pacific Railroad, the two major U.S. Western railroads, would no longer accept marine container terminals. Analysts differ on the severity an embargo of international intermodal traffic would have on rail service, but they agree it would be negative.”

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Bitcoins & the New Emerging Markets to Keep an Eye On

https://morailogistics.com/bitcoins-the-new-emerging-markets-to-keep-an-eye-on/

Although it’s only February, there are already two global trends in the supply chain logistics industry that’ll play a big part moving forward into future years.

The first trend that has been taking shape in recent years is that next-tier economies (emerging countries that are not Brazil, Russia, India, China and South Africa, also known as BRICS) are having their markets currently experiencing an influx of what Agility’s press release for the 2015 Agility Emerging Markets Logistics Index calls “dynamism”. This is happening in a time when the global economy is experiencing a cool down.

The second trend, which has been ongoing for the better part of two decades, is the continuing evolution of the digital sphere. Specifically, in how Bitcoin has been gaining traction as a medium of exchange in many emerging markets (including ones in Agility’s Index) and what that could mean for even the most basic of financial transactions in those countries.

A closer look at Agility’s 2015 Index

Though the findings and highlights of the Index are interesting, what is important for the purposes of this post is the quote by Essa Al-Saleh, President and CEO of Agility Global Integrated Logistics concerning the trend:

“A year ago, there was talk of an emerging markets meltdown and of a new ‘fragile five’ based on concerns about weakness in South Africa, Brazil, India, Turkey and Indonesia. Emerging markets as a group turned out to be far more resilient – even vibrant – than expected despite continued sluggishness in the global economy” said Al-Saleh. “The factors driving growth are increases in population, size of the middle class, spending power and urbanization rates, along with steady progress in health, education and poverty reduction” he continued.

Bitcoins and their role in emerging markets

This upward trajectory ties into the rise of Bitcoins in emerging markets. For the purpose of brevity, we’ll forgo explaining how it works and instead recommend this Wall Street Journal article by Michael J. Casey and Paul Vigna which explains it, and the ways it’s not just a digital currency.

Although Bitcoins have had several confidence damaging scandals, it’s still seen as having high utility in developing economies as it offers faster, more transparent, and sometimes a more stable alternative to local currencies that are experiencing high volatility. Min-Si Wang’s article in Forbes on subject gives further detail about Bitcoin adoption in emerging markets (for example, the trading volume of Bitcoin in China grew from 0.4 percent in 2012 to 4.7 percent in 2014).

A more critical article in Euromoney gives more numbers

According to Jana, a mobile-payments company that serves as many as 2 billion people in emerging markets, some 58% of those surveyed, from Vietnam to Brazil, said they would feel comfortable investing in a virtual currency, rising to 75% in Kenya, home of the wildly popular M-Pesa mobile-money network. In fact, in some countries, as many as a fifth of respondents claimed that virtual-currency investments were a safer long-term bet than stocks and property.

What does it all mean?

At a fundamental level, Bitcoins offers a cheaper alternative to the financial transactions offered by those offered by banks and credit companies. If Bitcoin became a global standard, well…

… this model could slash trillions in financial fees; computerize much of the work done by payment processors, government property-title offices, lawyers and accountants; and create opportunities for billions of people who don’t currently have bank accounts” writes Casey and Vigna. “Great value will be created, but many jobs also will be rendered obsolete.

The non-BRICS emerging markets are set to have a heavy impact on global business trends in the near future as their economies and logistical networks continue to strengthen. As they do, so does the faith open-source systems and digital money. The future looks to be very interesting in the coming years.

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Amazon and Target’s Canadian Experience

https://morailogistics.com/amazon-and-targets-canadian-experience/

Target, the U.S retailing giant has recently been getting a lot of attention from the Canadian press. Unfortunately for Target, the discussion has been how in this year alone, it had a $941 million loss in the Canadian market due to the baffling mismanagement and miscalculations it made it its first foray into a foreign market.

While Target had peers that failed in foreign markets for similar reasons it could’ve learned from, the biggest lessons it should’ve studied were those of Amazon’s which managed to not only capture 7 % of all e-commerce in Canada, but also has the potential to account for 1% of total retail sales in the country. Although the business models of the two companies are different, the obstacles, opportunities, and logistical limitations are not.

Planning vs. Buying

Amazon did a lot of preliminary work before opening its first Canadian distribution center in 2010.

- It had eight years of goodwill and visibility in the Canadian e-commerce market through amazon.ca

- It worked closely with the Canadian government to override certain Canadian foreign-ownership rules that would’ve been barriers to its expansion

- For its part of the partnership with the Canadian government, Amazon gave a $20 million investment commitment into Canada, $1.5 million of which went to cultural events and awards

- It ran a number of interviews and press releases addressing a number of concerns and criticisms from its critics while also communicating its intentions of gradually branching product categories

Target’s approach was considerably different. Instead of a slow province-by-province rollout, it tried to achieve “critical mass” from the onset by sinking $1.8 billion into buying out Zeller locations (which didn’t include renovation costs) and opened 124 stores across Canada in 2013.

Logistical Adaptability

Both companies faced logistical complications when they entered the Canadian market because of the country’s vastly differing regional tastes, strict trade and wage laws, and geographical vastness. As a result, the initial offering of both Amazon and Target for Canadians was paltry, and priced higher than their respective American counterparts.

Amazon’s approach to offset this problem was to offer a modest selection while maintaining the convenience it’s known for. It focused mainly on books and smaller items and overtime, introduced 14 new merchandise categories that would receive a lot of Canadian press attention. Through this, Amazon.ca was able to build for itself a loyal customer base. This approach also drew attention away from the inflated prices, which is a common technique amongst the successful American-based companies doing business in Canada.

Target hadn’t really planned outside of creating a Canadian specific brand (which failed to launch on time), and sticking rigidly to the management, sale, and promotional models that it had in the U.S., even when it clearly wasn’t working.

Differences in Canadian packaging laws, protectionist tariffs on some foods and exclusive wholesale arrangements also meant that the Canadian stores couldn’t be serviced from the company’s American distribution network. Many of the 124 Target stores had whole sections that were empty of products, while other items were overstocked and congested the supply lines further.

The empty stores led to customers instead focusing on price, which is an area a U.S based company can’t compete in for the reasons mentioned earlier.

Lessons Learned

When comparing Amazon’s success in Canada with Target’s failure, there are several lessons that can be learned

- Do your homework –Amazon did a lot of preliminary work before it entered into the Canadian market whereas Target simply assumed the business climate would be similar enough to its home base.

- Be flexible—Amazon success international is largely due to its ability to adapt to changing tastes and trends. Target’s failure in Canada is in large part due to its insistence on rigidity.

- Patience—Target sought to control a portion of the Canadian retail market at the onset. It failed to remember that entering a foreign market is a patience game, and as a result it lost billions.

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Why Transparency Isn’t Enough

https://morailogistics.com/why-transparency-isnt-enough/

Transparency was one of the most predicted trends for the logistics and supply chain industry in 2015. In the past, it was usually prohibitively expensive in both time and resources for businesses and customers alike to trace the origins of each aspect of a product. Now, there are a number of sites, institutions, and apps dedicated to making supply chain networks more visible. Large, network-dependent businesses such as Starbucks and Amazon have also adopted, and have started championing this trend.

Greater transparency is no longer just a lofty goal for the logistics industry; it is an essential business strategy if a company wishes to remain competitive.

However, there is one small but important detail that is over looked when discussing transparency. That is that a transparent supply chain is not necessarily the same as an ethical supply chain.

Customers Want Ethical, Not Just Transparent Supply Chains

McDonald’s recently made the mistake of confusing transparency with ethical when it launched its “Your Food, Our Questions” campaign in October. The campaign involved having videos and a section of their site dedicated to answering common customer questions about their products in great detail. Despite their effort at being more candid with its customers, McDonald’s has still received a lot of criticism for not actually doing anything about making any meaningful commitments towards sustainability.

For an older, more cautionary tale about not pushing for an ethical supply chain, read the story of Nike and its PR disaster that was born from its unethical suppliers that ultimately had Nike’s earnings fall 69%. Despite Nike previous attempts at being forward thinking by being open with its customers that it couldn’t reasonably keep track of its suppliers, and its declared commitment to uphold a higher ethical standard within its U.S facilities, it did little to stop the fallout of the scandal.

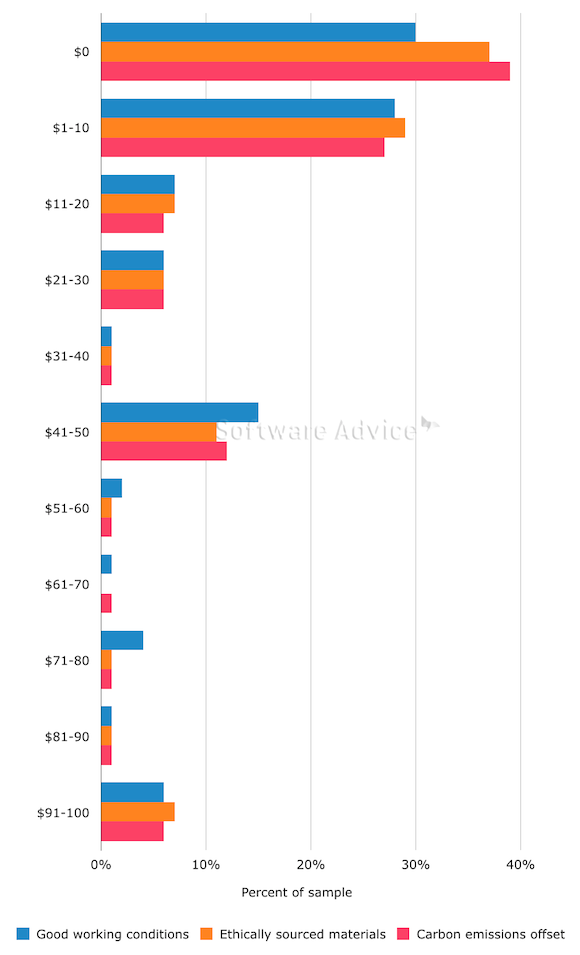

Looking at the Numbers

This past August, Forrest Burnson and his associates at Software Advice, a company that analyzes logistics software, published a summary of research they had conducted meant to gauge which initiatives along different links of the supply chain would make customers more likely to buy—or pay a premium for—a company’s products. The research, which was a series of surveys, asked participants how much more they would pay for a product that was produced more ethically with respect to a particular link in the supply chain: raw materials, manufacturing and distribution.

The study’s three key findings were,

- On average, consumers say they would pay 27 percent more for a product normally priced at $100 if it was produced under good working conditions.

- Consumers were split on whether improved working conditions, community involvement or environmental efforts would most convince them to buy from a firm.

- Twenty-eight percent of consumers said reducing water usage was an environmental initiative that would make them more likely to purchase a company’s products.

The implications of the study’s findings indicate that customers care most for “labor conditions for the workers who make their products” when given the choice to pay a premium for a better ethical standard in different areas. However, more importantly, the research also gives evidence that there is a very real market for ethical supply chains. This is a market that, in this writer’s opinion, will grow in tandem as transparency becomes ever more ubiquitous.

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Climate Change, Weather-proofing, and Adaptive Logistics

https://morailogistics.com/climate-change-weather-proofing-and-adaptive-logistics/

With January in full swing and the weather continuing to plummet, it is important to take a moment and discuss a topic that doesn’t receive as much mention as the more popular topics currently trending. This topic is the impact climate change is having on supply chain logistics.

According to The Associated Press’s study released in 2014 by the Intergovernmental Panel on Climate Change found that the increasing prevalence of severe weather will have negative effects on infrastructure, agriculture and the overall well-being of humans. As climate extremes continue affecting different parts of world, businesses and industries that are reliant on logistics networks are also at considerable risk.

A chilling look at a negative trend

A 2011 study released by EWENT (Extreme Weather impacts on European Networks of Transport) looked a number of detailed case studies and metadata to determine the costs and consequences of extreme weather on European freight and logistics industries and supply chains. The conclusion of the study was disheartening, as stated by the researchers:

The above attitudes indicate that business people in transport, logistics and infrastructure provision and management sectors did not have a good grasp of linkages between the probability of extreme weather and the risk of company damage

Although those surveyed in the study claimed they were prepared and had measures in place to account for weather extremes, they relied too heavily on government assistance claim the researchers,

Therefore, they could not carry out the risk tolerance appraisal and take decisions as to which preventive and risk mitigation strategies to employ. In the absence of understanding of their own risk tolerance threshold, they removed extreme weather hazards from strategic decision-agenda

… which as the study demonstrates, was to their own financial detriment. It isn’t all doom and gloom however.

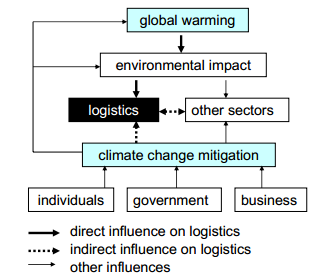

New field of study and Weather-proofing

‘Adaptive logistics’ has seen major growth since it was proposed in 2010 by Alan McKinnon and Andre Kreie of the UK based Logistics Research Centre at Heriot-Watt University. Their paper on the need for this to become a field for the logistics industry outlined how, at the time, not enough research existed on the impact climate change was having on supply chains. The term itself, ‘adaptive logistics’, is defined in the paper as a field of study that will analyze how logistics will respond to environmental change, and then “this response can either be direct where logistics systems must be modified to minimise adverse climate impacts or indirect, where climatic change alters the demand for logistical services and systems must be reconfigured accordingly”.

Some companies have also begun taking a more pro-active approach to reducing the potential risks of extreme weather affecting operations or revenue.

An excellent article by Inbound Logistics’s Gary Hanifan summarizes and analyzes the findings of Reducing Risk and Driving Business Value, a 2012 survey conducted by the Carbon Disclosure Project (CDP) and Accenture and gives advice as to how to raise supplier awareness about the risks climate change is having on their business. Some of the more interesting points quoted in the article were the following:

- A current or future risk related to climate change was identified by 70 percent of the 2,500 companies responding to the survey

- More than half of the supply chain risks due to drought and precipitation extremes are already affecting respondents’ operations, or are expected to have an effect within the next five years

- Other concerns include the potential for reducing or disrupting production capacity, reduced demand for goods, and even the inability to do business

- Supplier awareness is an even greater concern. Nearly one in five respondents indicate that their suppliers are not aware of the water risks affecting operations. Another 38 percent say their suppliers are aware of, but not actively engaged in, addressing the challenge

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Infographic: Top 10 Logistics and Supply Chain Facts of 2014

https://morailogistics.com/infographic-top-10-logistics-and-supply-chain-facts-of-2014/

We hope everyone has had a great holiday and we would like to wish all of our readers a Happy New Year! To kick off the year, we have finished compiling our infographic on the top logistics and supply chain facts from the news that we’ve collected throughout last year. As there is a large number of news items spanning the many large topics in the logistics industry, we decided to create our Top 10 by focusing on categories:

- Drones

- Same-Day Deliver

- Supplier Diversity and Women

- Sustainability

- RFID

- World Bank Institute’s Private Sector Platform

- Automation

- Online Retail

- Truck Driver Shortage

- Logistics Slow Growth

Each of these topics have some pretty interesting facts and statistics that may have been missed in the hustle and bustle of fellow logistics professionals and enthusiasts. And while we haven’t covered all of the interesting facts from 2014; we felt that these topics helped changes the face of the logistics and supply chain industry in 2014 and serves a good snippet to review the year.

Top 10 Logistics and Supply Chain Facts of 2014

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!

Revisiting Reverse Logistics in the Supply Chain

https://morailogistics.com/revisiting-reverse-logistics-in-the-supply-chain/

With the hustle and bustle of the holiday season come and gone, many people are now returning to their normal work and home life. That is, if you in any fields that are not retail or logistics.

After the holiday season, and especially after Christmas, many shipping services, retailers, e-retailers, and 3PLs get inundated by deluge of unwanted or ill-fitting gifts that need to be returned to their retailer of origin in a process called reverse logistics.

By simply looking at some facts and figures from this Wall Street Journal article, it is clear that the post-holiday time presents major opportunities for many 3PLs, especially those with a specialization in reverse logistics.

- 20 % of returns happen during the holiday season

- The U.S Postal Service reported handling 3.2 million returns last year during the two weeks following Christmas

- Returns policies are critical in driving purchase decisions. In a recent survey of 5,800 U.S. online shoppers, 82% said they were more likely to complete purchases if free returns via a prepaid shipping label or an in-store option were offered, according to comScore Inc., a data-tracking firm that conducted the study for UPS

- About 66% of consumers now review a retailers’ return policy before making a purchase

The opportunities inherent in reverse logistics, stems from the current e-commerce boom. As demand for online shopping grows, so the does the percentage of customers dissatisfied with their purchases. A large number of retailers and e-commerce companies are ill equipped with the growing number of returns (which is up 15% from the holiday season only two years ago).

With reverse logistical networks being an inherent part of many 3PLs to varying degrees, it makes sense that they be the natural choice for providing the service for other businesses. In fact, the necessity to switch toward more customer-centric strategies (such reducing lead times, improving planning, improving fulfillment, and improving post-sales/returns capabilities) is the focus of an article on MarketWatch.

It is in this same spirit of reverse logistical capitalization that FedEx recently announced its forthcoming acquisition of GENCO, a leading third-party logistics provider in North America that specializes in end-to-end reverse logistics.

Through GENCO’s leadership position in reverse logistics, FedEx will be able to expand its North American presence in the e-commerce market as GENCO’s reverse logistics customer base includes some of the top companies in the technology, retail, and healthcare industries in North America.

An article in SupplyChain Management Review has very interesting information concerning best practice for reverse logistics when it quotes Gary Cullen, chief operating officer of 4PRL LLC:

“A growing trend of being “cheaper and nearer” seems to fit well within the cost sensitive and eco conscious reverse logistics chain of events.

Much efficiency can be found in near-sourcing third party service providers (3PSP) who specialize in the services of redeployment, repair, reuse, recycling, reclamation and resale. This appears to be a successful business model in today’s fuel conscious and green minded environment.

A closer country allows for use of cheaper modes of transportation as well as less overall time and movement.”

Efficiency and response time are the key terms to take away when discussing reverse logistics as the problem of potential value loss arises if items are delayed for too long, especially when it involves fashion items.

That’s it for us this week! If you liked this blog post, why not subscribe to our blog? If you’re interested in what we do as a 3rd party logistics provider, don’t hesitate to check out our services (as expressed above, we are very pro finding you the lowest total cost!). We’re also in the twittersphere, so give us a follow to get the latest logistics and supply chain news!